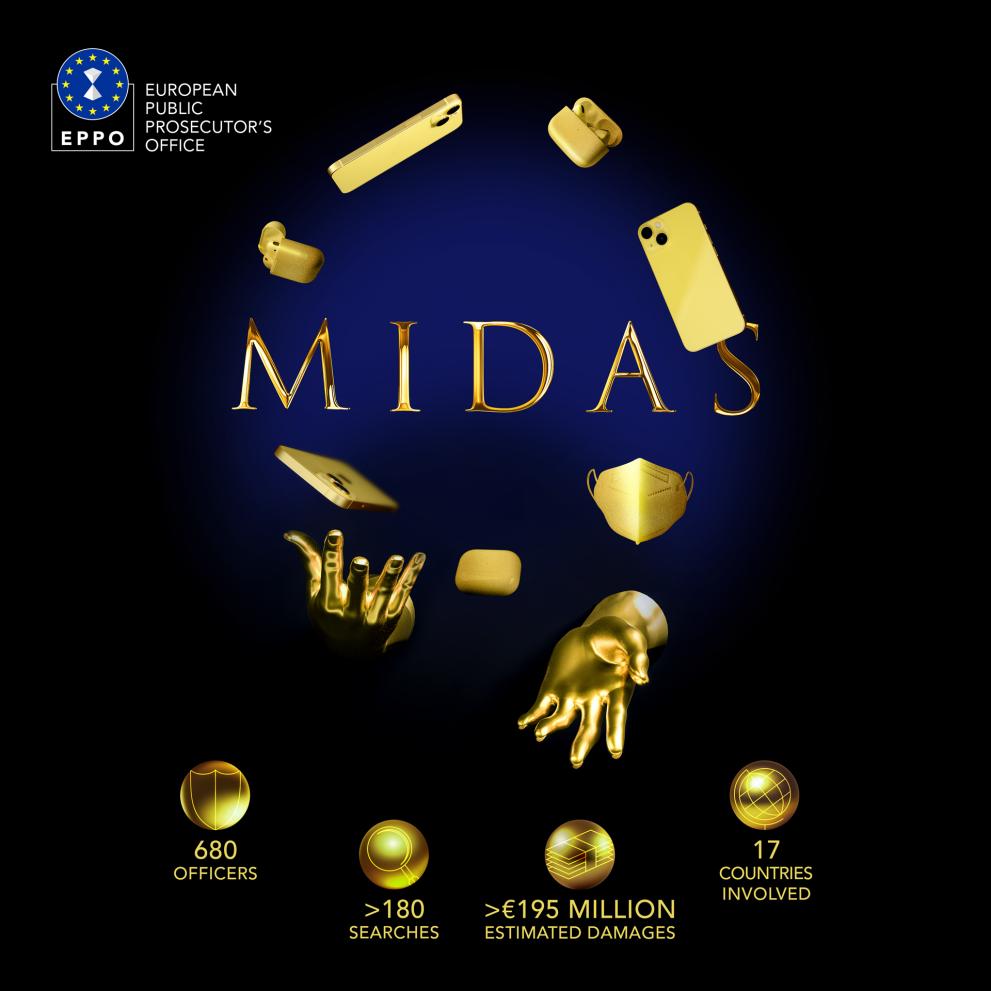

(Luxembourg, 29 February 2024) – Yesterday, the European Public Prosecutor’s Office (EPPO) in Munich and Cologne (Germany) moved against a suspected criminal organisation, believed to have orchestrated a massive €195 million VAT fraud through the sale of smartphones, small electronic devices and protective face masks. During yesterday’s transnational action led by the EPPO, under the investigation cluster Midas, more than 180 searches were carried out and 14 people were arrested in 17 countries (Albania, Austria, Croatia, Cyprus, Czechia, Estonia, Germany, Hungary, Italy, Malta, the Netherlands, Poland, Portugal, Slovakia, Slovenia, Sweden and the UK). Over 680 tax and police investigators supported the investigative measures.

During the searches, law enforcement seized vast quantities of smartphones, worth more than €15.3 million, as well as a yacht, worth €3 million, and €1.2 million in cash and cryptocurrency. Several cars were seized, including a Rolls-Royce, a BMW and a Range Rover. Jewellery, luxury watches and 2.5 kg of gold were also found in the suspects’ residences.

At issue is a suspected VAT carousel fraud – a complex criminal scheme that takes advantage of EU rules on cross-border transactions between its Member States, as these are exempt from value added tax (VAT).

Complex criminal ecosystem

The investigation revealed that the suspected organisers of the VAT fraud created a complex criminal ecosystem, which allowed them to defraud up to €195 million through several criminal schemes.

It is alleged that, since 2017, a German conduit company has led different VAT fraud schemes involving the trade of small electronic goods, including smartphones. It is understood that the suspects used fraudulent chains of missing traders, which would vanish without fulfilling their tax obligations.

In 2020, the same organisers of these VAT fraud schemes are believed to have entered the market for protective face masks. During the Covid-19 pandemic, protective face masks were in high demand; the company managed by the suspects is understood to have bought them from a missing trader, and channelled them through several buffer companies to disguise their final destination. On paper, their company was based in Hong Kong, but the face masks were actually in a warehouse in Germany, and remained there until the German Federal Ministry of Health purchased them from the company ostensibly based in Hong Kong. According to the investigation, neither the company at the beginning of the supply chain, nor the Hong Kong-based company, reimbursed the VAT they had received upon the sale of the face masks to the ministry.

Ultimately, the suspected criminal organisation behind the identified VAT fraud schemes is believed to have created layers of shell companies, straw men, fictitious identities and secret communication to mask their criminal activities.

Outstanding and longstanding cooperation

What made Midas even possible is EPPO’s unique ability to cluster investigations transnationally, combined with unprecedented speed in the cross-border acquisition of evidence under the provisions of Articles 31 and 32 of the EPPO Regulation.

Two-and-a-half years of identifying and linking seemingly individual offences as well as more than 200 requests for assisting measures (Article 31) issued and answered by 14 European Delegated Prosecutors in 12 Member States working as a team allowed for today’s action. The operational model of the EPPO as single office makes it possible to detect cross-border criminal networks, but also to obtain evidence much more quickly and in a by far more comprehensive manner than under the usual judicial cooperation modalities.

It is particularly complex to identify a conduit company at the core of a VAT fraud scheme trespassing numerous countries and legislations. Thanks to the joint efforts of the EPPO, European partners and national authorities, the different layers of shell companies, straw men, fictitious identities and secret communication could be uncovered, and the suspected criminal organisation understood to be behind the numerous VAT fraud schemes could be identified.

The arrests are the result of special investigative measures carried out by a number of German Tax Investigation Offices in Berlin, Bielefeld, Cottbus, Münster and Nuremberg. This extensive undertaking also counted on the support of Eurojust and Europol, and that of several national law enforcement agencies. In Germany, these included Police Headquarters (Polizeipräsidium) from Nordhessen and Brandenburg, as well as the State Criminal Police Offices (Landeskriminalamt) from Brandenburg and Berlin.

The EPPO is the independent public prosecution office of the European Union. It is responsible for investigating, prosecuting and bringing to judgment crimes against the financial interests of the EU.

List of main partners and national authorities involved:

- Europol

- Eurojust

- German Tax Investigation Offices in Berlin, Bielefeld, Cottbus, Münster and Nuremberg

- German criminal police investigation units: Landeskriminalamt Berlin, Landeskriminalamt Brandenburg, Polizeipräsidium Nordhessen and Polizeipräsidium Brandenburg

- Albania: Special Prosecution Office against Corruption and Organized Crime (SPAC)

- Austria: Amt für Betrugsbekämpfung (ABB)

- Cyprus: Police Cyprus Department

- Czechia: National Organized Crime Agency (NCOZ)

- Estonia: Estonian Tax and Customs Board (EMTA)

- Italia: Guardia di Finanza (GdF)

- Malta: Financial Crime Investigation Department (FCID)

- Netherlands: Fiscal Information and Investigation Service (FIOD)

- Poland: Warsaw Police Department for Economic Crimes

- Portugal: Guardia Nacional Republicana (GNR)

- Sweden: Swedish Economic Crime Authority (SECA)

- Slovakia: Národná Kriminálna Agentúra (PPZ)

- UK: Her Majesties Revenue & Customs (HMRC)