Action day with over 450 searches in 7 countries

More than 2000 tax, customs and police investigators in seven countries (Belgium, Germany, Hungary, Italy, the Netherlands, Portugal and Spain) are currently carrying out an action day with over 450 searches, as well as seizures of real estate and luxury cars. Five people were arrested today, 14 June 2023.

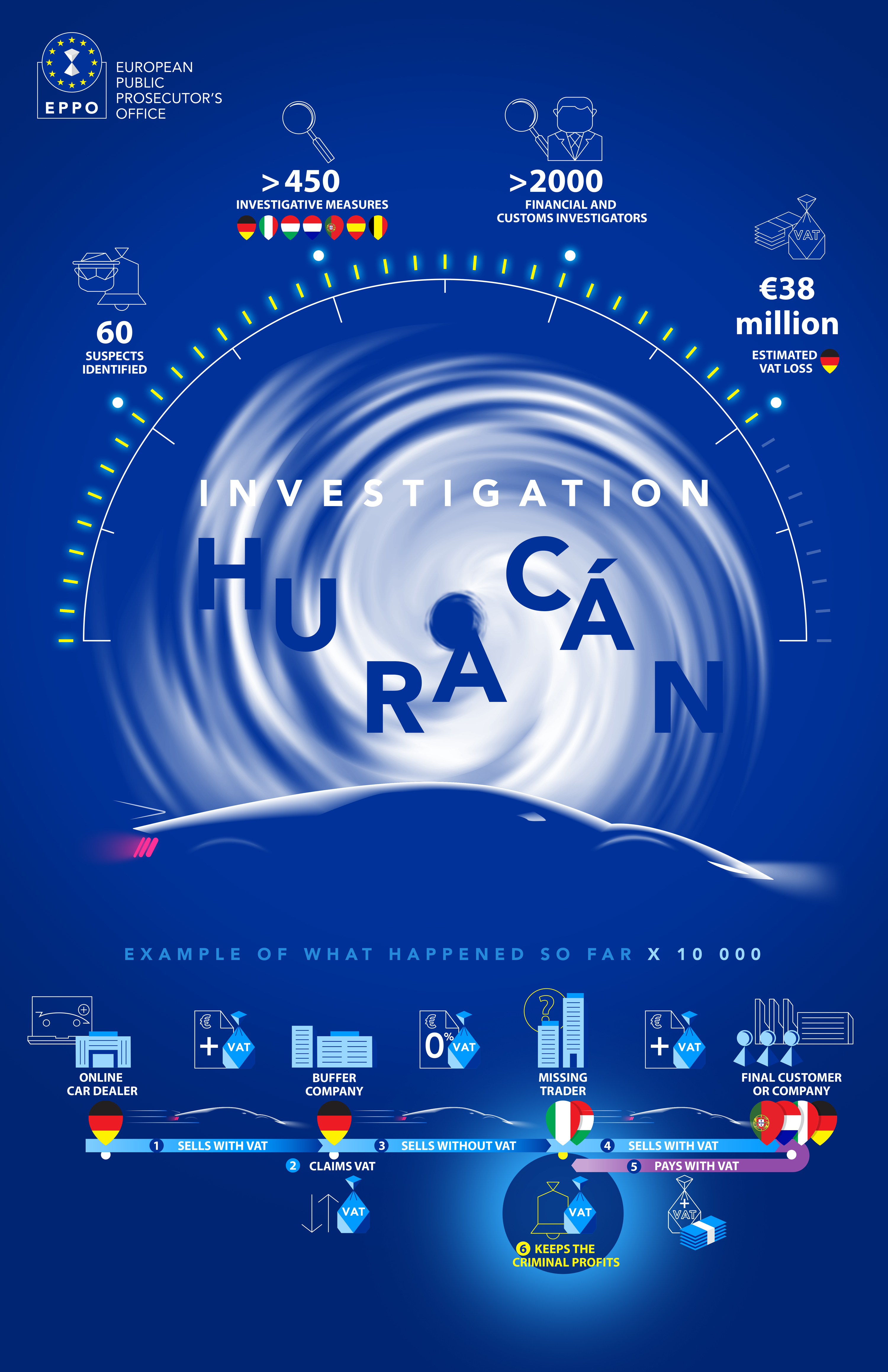

The European Public Prosecutor’s Office (EPPO) in Cologne (Germany) leads this investigation, code-named Huracán, after their discovery of a large VAT fraud scheme concerning the international trade of more than 10 000 cars. The total fraudulent turnover of the organised crime group behind the scheme is estimated at €225 million, and the estimated VAT damage caused by the suspects amounts to at least €38 million.

Missing VAT payments

This investigation originated in January 2021 with a report from a tax authority in Italy to the German Federal Central Tax Office, about missing information on the purchase and potential resale of cars imported from Germany to Italy. The Münster tax investigation office opened an investigation, which was evoked by the EPPO office in Cologne shortly afterwards.

The EPPO’s European Delegated Prosecutors, together with specialised financial investigators from the EPPO’s Central Office in Luxembourg, soon uncovered a large-scale international VAT fraud scheme run by an organised crime group.

High frequency trading of cars

The evidence shows that the scheme consisted of a vast network, coordinated by an organised crime group, and operated in the following manner:

A Germany-based buffer company, considered a legitimate company on paper, bought cars from a German car dealer. They paid the price including VAT, introduced a VAT claim and received back the VAT from the German state.

Afterwards, they sold the cars to missing traders outside Germany, namely Italy and Hungary. The price of the car was then slightly above the net price indicated on the original invoice from the online marketplace, but already more attractive, as the missing traders did not have to pay VAT due to the intra-community VAT rules.

The missing trader then sold the cars at a very appealing price to a final customer or another company. The final customer paid the VAT, and instead of paying the VAT to the German state, the missing traders – as the name implies – kept it as profit, and disappeared.

It is estimated that more than 10 000 cars were sold using this scheme and in total, around 60 people are suspected of participating in the organised group or supporting the main suspects, who were arrested this morning. Between 2017 and June 2023, they managed to generate a total fraudulent turnover of over €225 million and created VAT losses of over €38 million.

Unfair competition

According to the evidence, the suspects regularly issued false invoices to the respective private individuals or traders, which made it seem as though they had correctly purchased the vehicles and paid VAT. Thanks to those invoices, the buyers were subsequently able to register the vehicles purchased in another country.

This scheme allowed unfair competition, as the cars were being sold at a lower market price. The investigation provides grounds for suspicion of VAT fraud, tax evasion, organised crime, money laundering and forgery of documents.

Measures to recover the damages have been taken, and more details will be communicated once known.

List of most important partners and national authorities involved:

-

Tax investigation office, Münster (Germany)

-

Customs investigation office, Essen (Germany)

-

Specialised prosecution office for white collar crime, Düsseldorf (Germany)

-

Central office of North Rhine-Westphalia for fighting VAT fraud (ZEUS NRW, Germany)

-

Federal Criminal Police Office (Germany)

-

Guardia di Finanza, Italy

-

National Republican Guard – Fiscal Action Unit, Portugal

-

National Tax and Customs Administration, Directorate General of Criminal Affairs, Central Bureau for Criminal Investigations, Hungary

-

Chief Prosecution Office of the Capital, Hungary

-

Fiscal Information and Investigation Service (FIOD), Eindhoven (Netherlands)

-

Guardia Civil, Spain

-

Federal Police, Belgium

-

Europol

The investigation and action day have been supported by the Operational Network (@ON), funded by the EU (Project ISF4@ON).