The EPPO sets new standard in cross-border financial investigations

Today, the European Public Prosecutor’s Office, in cooperation with law enforcement agencies of 14 EU Member States, carried out simultaneous investigative measures, including more than 200 searches, in relation to a complex VAT fraud scheme based on the sale of popular electronic goods. This action took place in Belgium, Cyprus, France, Germany, Greece, Hungary, Italy, Lithuania, Luxembourg, the Netherlands, Portugal, Romania, Slovakia and Spain. Within the framework of this flagship EPPO operation, searches were already conducted in Czechia, Hungary, Italy, the Netherlands, Slovakia and Sweden on 12 and 13 October 2022.

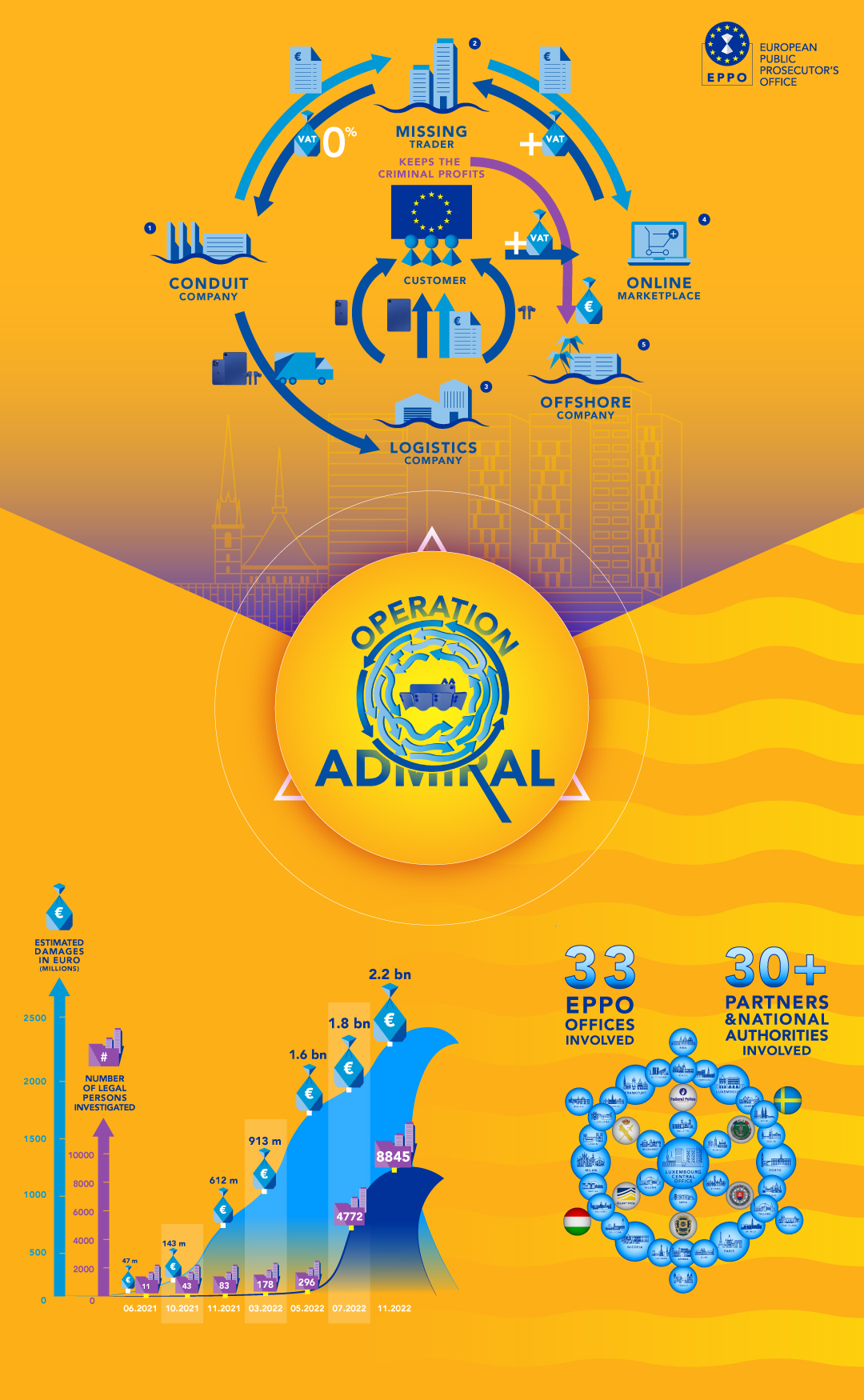

All the data collected is being analysed, and the investigation into the organised crime groups behind this scheme is continuing. The estimated damages investigated under Operation Admiral currently amount to €2.2 billion. Measures to recover the damages have been taken, and more details will be communicated once known.

It started small

In April 2021, the Portuguese Tax Authority in Coimbra was looking into a company selling mobile phones, tablets, earphones and other electronic devices, on suspicion of VAT fraud. When the EPPO started operations in June 2021, in line with their legal obligation, the Portuguese authorities reported the case to the EPPO.

From a national perspective, based on the administrative investigation, the invoicing and tax declarations seemed to be in order. However, the Portuguese European Delegated Prosecutors decided to investigate further. Working together across borders, European Prosecutors, European Delegated Prosecutors, the EPPO’s financial fraud analysts and representatives from Europol and national law enforcement authorities gradually established connections between the suspected company in Portugal and close to 9000 other legal entities, and more than 600 natural persons located in different countries. Eighteen months after receiving the initial report, the EPPO is now exposing what is believed to be the biggest VAT carousel fraud ever investigated in the EU.

The criminal activities are spread throughout the 22 EPPO participating Member States, as well as Hungary, Ireland, Sweden and Poland, along with third countries including Albania, China, Mauritius, Serbia, Singapore, Switzerland, Turkey, the United Arab Emirates, the United Kingdom and the United States.

The involvement of organised crime groups

Beyond the size of the damages, what makes this VAT carousel fraud stand out is the extraordinary complexity of the chain of companies. From companies acting as apparently clean suppliers of electronic devices, and those claiming VAT reimbursements from the national tax authorities while selling these devices online to individual customers – and subsequently channelling the proceeds of these sales offshore, before disappearing themselves – to those laundering the proceeds of this criminal activity.

These activities would not be possible without the involvement of several highly skilled organised crime groups, each of which has specific roles in the overall scheme. Working transnationally, almost with an industrial logic, they have been avoiding detection for years.

The EPPO capability

Based on the latest estimate by Europol, VAT carousel fraud, or Missing Trader Intra-Community (MTIC) fraud, is the most profitable crime in the EU, costing around €50 billion annually in tax losses to the Member States. Cross-border by definition, once it reaches a level of complexity comparable to that seen under Operation Admiral, this type of fraud is almost impossible to uncover from a purely national perspective.

Using the central EPPO Case Management System, the access to national and European databases, supported by the EPPO Central Office analytical and investigative capacity, as well as by Europol and national law enforcement actors, the European Prosecutors were able to design and implement a common investigative approach to a whole net of organised crime groups.

European Chief Prosecutor Laura Kövesi said:

"With Operation Admiral, the European Public Prosecutor’s Office is putting a highly sophisticated criminal industry into the spotlight. It has been prospering in the European Union notably due to the structural limitations of national tax and law enforcement authorities, when it comes to cross-border financial criminality.

Without the EPPO, this kind of operation would have taken years to prepare – or more likely, would never have taken place. Operation Admiral is a clear demonstration of the advantages of a transnational prosecution office. When it comes to VAT fraud, from a national perspective, the damages can be assessed as relatively small or non-existent, or even remain undetected. You need a helicopter view, to see the whole picture.

It took the EPPO less than 18 months from the initial crime report to uncovering a whole web of organised crime groups, responsible for a staggering €2.2 billion loss to EU taxpayers. I believe this is Europe’s biggest VAT fraud discovered so far."

List of most important partners and national authorities involved:

-

Europol

-

Belgian Federal Police

-

Police of Cyprus

-

Law Office of the Republic of Cyprus

-

Judicial Investigation Unit of the French Ministry of Finance

-

Hesse Regional Tax Office (Germany)

-

Hamburg Tax Investigation Office (Germany)

-

Tax Investigation Office Schwäbisch Gmünd (Germany)

-

Reutlingen Tax Investigation Office (Germany)

-

Financial Police of Athens

-

Italian Guardia di Finanza

-

Financial Crimes Investigation Service under the Ministry of the Interior of the Republic of Lithuania

-

Grand Ducal Police of Luxembourg

-

Fiscal Information and Investigation Service (FIOD) of the Netherlands

-

Tax Fraud Investigation Central Department of the Tax and Customs Authority of Portugal

-

Portuguese Judiciary Police

-

Portuguese Guarda Nacional Republicana

-

General Directorate of the Police of Bucharest

-

Slovak Police Force Presidium

-

Spanish Guardia Civil